The world of banking can feel a bit overwhelming at times, especially when you start looking at stocks, indexes, and share prices. If you’ve ever glanced at the London Stock Exchange, you might have noticed how the Royal Bank of Scotland, now part of the NatWest Group, moves day-to-day. Understanding the RBS share price isn’t just about numbers—it’s about seeing the bigger picture of the banking sector, the economy, and even consumer confidence.

In this article, I’ll break down everything you need to know about the RBS share price, what drives it, and why it matters. I’ll also share some real-life examples and insights to help you get a clearer picture, even if you’re not a finance professional.

Understanding RBS and Its Place in NatWest Group

RBS, officially merged under the NatWest Group brand, has a long history in the UK banking sector. You might remember the times when RBS was a standalone giant with branches all over the country. Now, as part of NatWest Group, it continues to operate under the familiar RBS branding for certain services, while the group manages overall strategy and investment decisions.

For investors, knowing the corporate structure matters because the RBS share price reflects not only RBS performance but also the broader health of NatWest Group. For instance, if NatWest launches a new business initiative or announces a dividend, that can influence RBS’s trading value indirectly.

What Influences the RBS Share Price?

The stock market is a living organism, and the RBS share price fluctuates for several reasons. Here’s a breakdown of key factors:

Economic Conditions

Banks are extremely sensitive to economic shifts. During times of economic growth, lending tends to increase, credit risk decreases, and banks see higher profits. Conversely, during a slowdown, the RBS share price can dip as investors anticipate lower earnings and higher potential loan defaults. Remember the financial crisis? That’s a prime example of how macroeconomic forces can impact share prices.

Interest Rates

Interest rates set by the Bank of England play a crucial role. When rates rise, banks like RBS can earn more from loans, which can push the share price up. If rates fall, profits may shrink, and investors might react accordingly. It’s a balancing act, and RBS investors often track central bank announcements closely.

Corporate Actions and Announcements

Every merger, acquisition, or share buyback can shift investor sentiment. For example, when NatWest announces a share buyback program, it often boosts confidence and may lift the RBS share price. On the flip side, negative news like regulatory fines or restructuring can drag the price down quickly.

How to Read RBS Share Price Movements

If you’re new to investing, charts and numbers can seem confusing. Let’s simplify it:

- Opening Price: This is where RBS starts trading each day. It’s influenced by overnight news and global markets.

- High and Low: These numbers show the extremes of daily trading. Watching these can give a sense of market volatility.

- Market Cap: The total value of all shares in the company. It’s a handy way to compare RBS with other banks.

- Dividends: If you hold RBS stock, dividends are your share of profits. Changes in dividend policy often affect the share price.

Think of it like watching a football match. Each number tells part of the story, but it’s the context—news, investor sentiment, and economy—that really matters.

Comparing RBS Share Price with Other UK Banks

Investors often compare RBS with peers like Barclays, HSBC, and Lloyds. Why? It gives perspective. For instance, if all banks drop in price after a regulatory announcement, it’s not just RBS—it’s the sector reacting. Conversely, if RBS outperforms its peers, it might suggest strong internal performance or effective management.

I once noticed that during a particular quarter, while Barclays stock remained steady, RBS’s price rose steadily. This was due to NatWest’s strong quarterly earnings report, showing how corporate performance drives individual stock movements.

Long-Term Trends and Investor Behavior

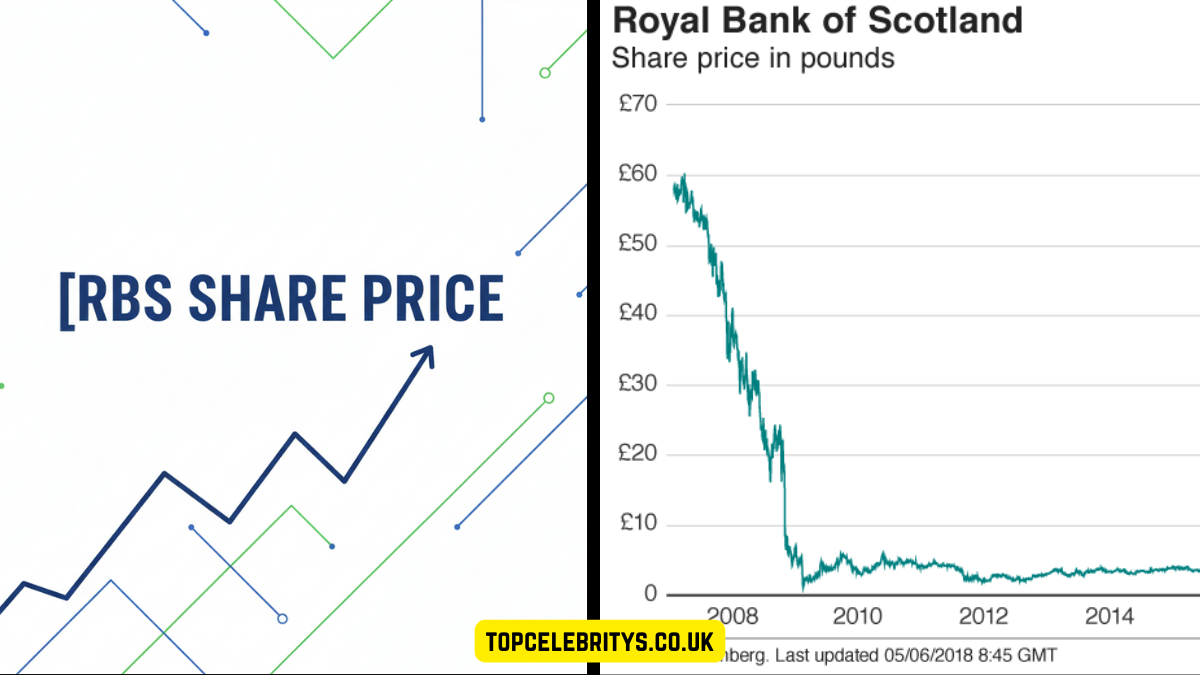

RBS’s share price history tells an interesting story. There have been periods of rapid growth and steep declines. Understanding long-term trends can help investors make more informed decisions. For example, after the 2008 financial crisis, RBS’s stock took years to recover. Watching these patterns over time gives insight into risk and opportunity.

Another factor is investor behavior. Some people buy shares based on short-term news, while others focus on long-term potential. Personally, I’ve found that a mix of both approaches often works best—keeping an eye on daily trends but grounding decisions in long-term fundamentals.

Real-Life Example: Dividend Impact on Share Price

A few years ago, NatWest Group adjusted its dividend policy. Even a small increase in quarterly dividends can make shares more attractive. Many investors bought RBS stock in response, causing a noticeable uptick in the share price. It’s a simple lesson: dividends aren’t just cash payouts—they signal confidence in the company’s financial health.

Tools to Track RBS Share Price

Keeping tabs on the RBS share price is easier than it used to be. You can use:

- London Stock Exchange website: Provides official trading data.

- Finance news portals: Sites like Yahoo Finance, MarketWatch, and Investing.com offer live updates and analysis.

- Broker apps: Most modern apps allow you to set alerts for price changes, dividends, and news.

Personally, I like combining a couple of sources. The official data gives accuracy, while finance portals provide context and interpretation.

Risks to Consider Before Investing

Investing in RBS is not without risk. Here are a few to keep in mind:

- Market volatility: Bank stocks can swing widely in response to global events.

- Regulatory changes: New laws or penalties can affect profitability.

- Economic shocks: Recessions or unexpected crises impact lending and investment returns.

- Interest rate fluctuations: Rapid changes can affect net income and, therefore, stock valuation.

The key is not to panic. Understanding these risks helps investors make rational decisions instead of reacting emotionally to every price movement.

How RBS Share Price Reflects Broader Market Sentiment

One of the most interesting things about bank stocks is how they mirror broader investor confidence. If the market believes the economy is stable, banks like RBS tend to do well. Conversely, fear or uncertainty often hits financial stocks first. In that sense, tracking RBS isn’t just about one company—it’s a window into the UK economy.

FAQs About RBS Share Price

1. What drives changes in RBS share price?

Daily fluctuations are influenced by interest rates, corporate announcements, economic news, and broader market trends.

2. Is RBS share price affected by global markets?

Yes, international events, particularly in the financial sector, can impact UK bank stocks, including RBS.

3. How can I track RBS share price daily?

You can use official stock exchange websites, finance portals, and brokerage apps for live updates and analysis.

4. Does RBS pay dividends?

Yes, RBS, under NatWest Group, pays dividends. Changes in dividend policy can influence investor behavior and the share price.

5. Should I focus on short-term or long-term trends?

Both matter. Short-term trends capture immediate market sentiment, while long-term trends provide insights into stability and growth potential.

Conclusion

Understanding the RBS share price isn’t just about looking at numbers—it’s about interpreting a story of banking, economy, and investor sentiment. Whether you’re a casual observer or considering investing, paying attention to trends, news, and financial health can give you a clearer perspective. Remember, stock prices fluctuate for many reasons, and the best approach is informed observation rather than reactive decisions.

Read Also